In his new article, published on July 24th in the “Revista de Cinema,” Steve Solot, LATC President, and Associate for Latin America, Olsberg•SPI, highlights the importance of having a national incentive for international production and the benefits that it brings to the country’s local industry and economy.

Below the English version of the article:

Why does Brazil still not have an incentive for international audiovisual production?

By Steve Solot

Published 7/24/2023, Revista de Cinema

This is an intriguing question!

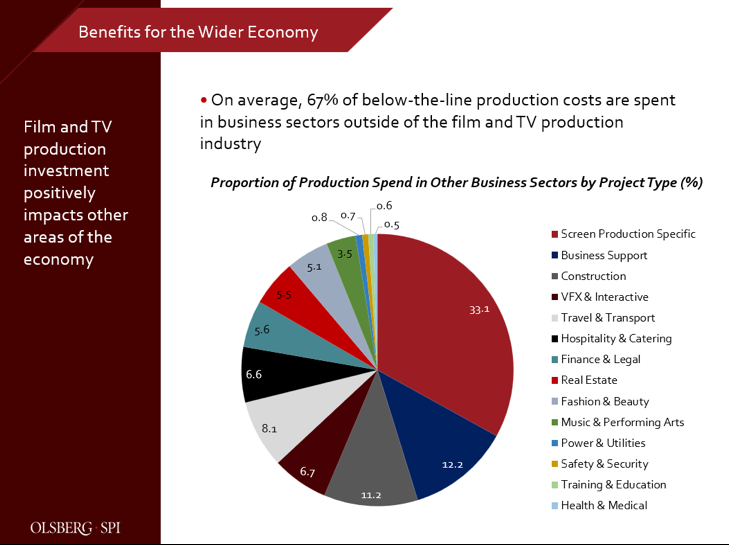

Perhaps policy makers in Brazil are not aware of the benefits of attracting international productions of audiovisual content to the country, and that the local industry is not the only beneficiary. In fact, as widely publicized in studies by the Olsberg•SPI consultancy, approximately 67% of an audiovisual production’s expenses reach sectors outside the film industry, as shown in the following graph.

Recommendations for the creation of such an incentive in Brazil have occurred multiple times over the years. For example, in my article published by REVISTA DE CINEMA on January 10, 2013, as president of the Rio Film Commission at the time, I explained that the year 2012 was marked by great advances in the structuring, creation of incentives and promotion of film commissions in Latin America. The same progress, however, was not shared by Brazil.

Once again, on September 28, 2018, in my presentation to Ancine’s FSA Management Committee, as Executive Director of the Brazilian Film Commissions Network-REBRAFIC, and president of LATC, I commented on the recommendations of the newly created Interministerial Working Group, and among them, “carrying out specific studies with a view to adopting measures aimed at strengthening and increasing the competitiveness of national film commissions”, such as the creation of incentives. The presentation highlighted 12 specific guidelines for creating an incentive model to attract foreign productions.

Another relevant example for Brazil is the recent study on the potential for federal incentives for audiovisual production in Mexico published by Olsberg•SPI last month, “An Incentive to Audiovisual Production for Mexico”, which can be downloaded in English or Spanish here. The study examines what the absence of this incentive has meant for the Mexican audiovisual sector, and what an incentive of this type can offer in the future in terms of increased employment and economic impact. It also examines the broader strategic benefits of film and television production in Mexico.

More recently, in her interview published on Tela Viva News, Juliana Funaro highlighted the need for a cash rebate mechanism in Brazil: Especialista em coproduções, Barry Company destaca necessidade de mecanismo de cash rebate no Brasil

In fact, a quick look at the scenario of incentives for international production shows that many countries are creating and/or increasing or improving their incentives, precisely to attract more international productions, due to the positive impact they have on the economy as a whole and on the national film industry specifically. According to the Olsberg•SPI May Global Incentives Index, the number of incentives worldwide increased from 86 in 2017 to 111 in 2023.

And Spain is one of the best examples. On January 1, 2023, the province of the Basque Country introduced new tax incentives with one of the highest (if not the highest) deduction rates in the world: up to 70%. Also on January 1, mainland Spain raised the discount limits on TV dramas to 10 million euros (about 53 million reais) per episode, an amount that rises to 18 million euros (about 95 million reais) per episode in the Canary Islands.

Few countries can match this level of encouragement. Introduced in 2015 and increased in 2016 and 2020, mainland Spain’s incentives reach 30% for a first spend of €1 million, and 25% for subsequent spends. And the total available resources increased from 19.5 million euros in 2019 to 153 million in 2022.

The importance of incentives for international production was also highlighted by the Inter-American Development Bank, in its publication “Creativity and Investment for Latin America and the Caribbean 2021”: “Although some countries have developed legal frameworks through film laws and state and national programs to accelerate the growth of the sector, many others are in a difficult position to compete with more consolidated audiovisual centers in the world, which offer talent, infrastructure and direct incentives.”

Meanwhile, in Brazil, while there is still no federal incentive for audiovisual production, the municipalities of São Paulo and Rio de Janeiro have taken the initiative to introduce their own production incentives in the form of “cash rebates”, and other cities are preparing to do the same.

However, at the national level, the question remains: when will policy makers in the federal government wake up to the positive impacts that Brazil is failing to receive in terms of economic development, job creation and promotion of the national film industry?